One of the topics that interests me most is finance and money. I’m not greedy, but seeing how my parents have worried about money makes me want to put in the effort now and get to a point where that won’t be a problem for myself and my future family, there are enough stresses in life already, a lot of them compounded when you’re running low on dinero.

After I left school I was earning pretty good money for my age and living with my parents. Paying next to nothing for rent meant that money burned a hole in my pocket. Within reason, I could buy pretty much anything a young person would want, pointless expenditures really on stuff like technology and what I’d deem toys. I’m glad I did, because in doing so I feel like I got it out of my system and if I didn’t I’d always think I’d need it. Now I view saving and making money like a game, every day I’m reaching a new high score and viewing it like this makes saving/investing rewarding. My girlfriend was the catalyst for this transformation and I only wish she had gotten to me sooner.

I’ve got a lot of books about money and business and people with similar interests always seem to have read one of Kiyosaki’s books, usually ‘Rich Dad Poor Dad.’ It is one of the best selling financial books of all time and I think for good reason. I also couldn’t say no when I was looking to pick up some more books and it was less than a fiver.

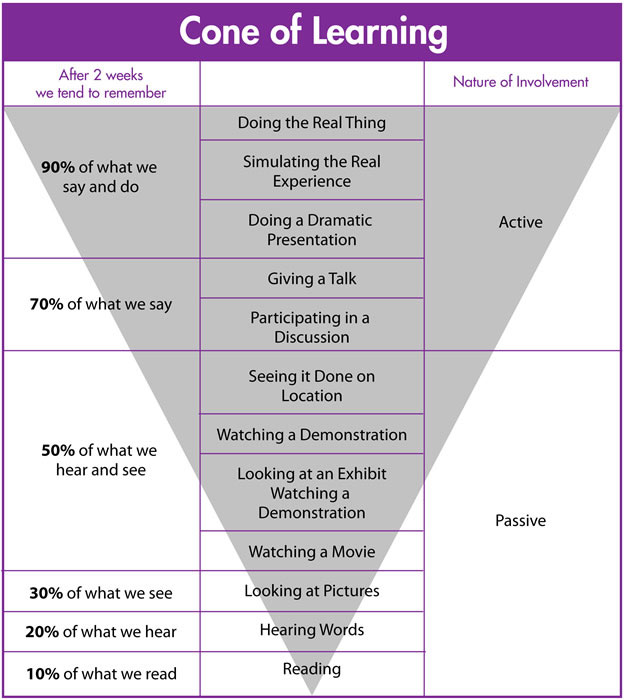

The book is put together in an interesting way – Kiyosaki himself admits that he isn’t the best writer – but when you read ‘Rich Dad Poor Dad’ you essentially read the book 3 times in 3 slightly different ways. The first is of Roberts lessons that he learned from his rich dad and his poor dad; the second is a summary of the previous chapter, essentially going over the previous chapter in a more condensed way and the third is the study section. This encourages discussion and reflection upon what you have just read. An unusual way of reading and whilst it could come across as lazy writing, I think that Kiyosaki is very deliberately structuring the content in a way the encourages learning retention through repetition. He also brushes past the concept of Edgar Dale’s “Cone of Experience” early on which I think helps add some context to this style of revisiting content.

I took a lot of good simple concepts out of this book. But here is what it taught me in a nutshell (I made a lot of notes about this book, but if I put them all here even I wouldn’t make it to the end of the list):

- Poor people work for money, rich people have money work for them

- Spend time buying or creating assets and you’ll get rich

- Instead of buying a liability like a car, buy assets that will generate the cash to buy it for you

- Earning more money does not equal having more to spend, you must develop your financial IQ and learn how to manage money, not just make it

- You must know the difference between an asset and a liability and only buy assets

- When asset income generation exceeds expenses, the rest is re-invested. Which is what makes the rich richer

- Taxation destroys growth, but there are ways to minimise taxes

- Rich people buy luxuries last, poor people buy them first

- You should pay yourself first, even if it means you’ll be short of money, it will motivate you to make more

- Don’t let doubtful people sway your judgement, there will always be someone that thinks the “sky is falling” doubts and cynicism is what keeps people poor

- One of the most common forms of laziness, is staying busy *

- Swap “I can’t” with “how can I?” to push yourself into thinking up a solution

- Use failure as a motivator for success, instead of giving up

- The best way to learn something, is to teach it to someone else

- Your most important asset for creating wealth is your own knowledge/education, something you are in complete control of

* This was an eye-opener for me because I realised I’m guilty of doing it all the time. How many times have you been “too busy” to do something that is unpleasant, but you know should be done because you were filling your time with anything but the task you were avoiding?

Overall, it was a great book and I’m pleased I read it, but reading a book and doing nothing that it teaches is time wasted. This has inspired me to make changes to the way I think and act about finance already and I believe has helped me build on some core principles that will steer me until I’m old.

If you want it, pick it up here.